cryptocurrency tax calculator australia

How to use our Australian crypto tax calculator. Therefore to accurately calculate your tax liability it is important to maintain records of all your cryptocurrency exchanges.

I Highly Recommend Cointracking Info For Cryptocurrency Traders To Stay On Top Of Their Gains And Do More Best Crypto Portfolio Management Best Cryptocurrency

You must first calculate your cost base.

. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you. Cryptocurrency Tax Calculator Australia. Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes.

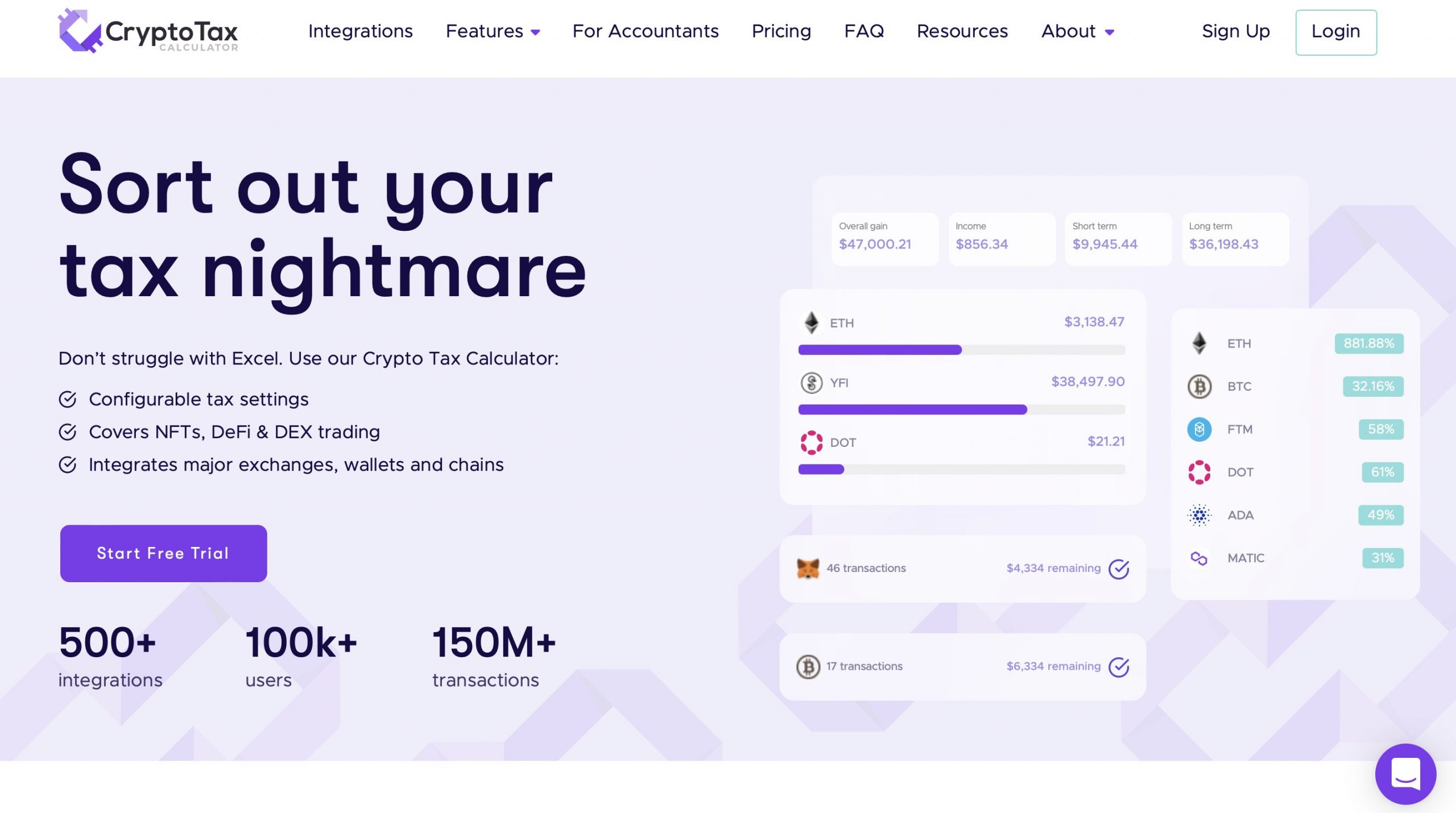

Quick simple and reliable. Youll need 2 forms one for income and one for capital gains. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

Ad Trade crypto plus stocks options futures bonds funds and more on one platform. Overall Koinly is the best cryptocurrency tax software for Australians to stay compliant with the Australian Tax Office ATO. Their platform integrates with the most exchanges and NFT DeFi.

For detailed information on how cryptocurrency is taxed in Australia read Swyftxs Crypto Tax Australia Guide for 2021. Calculate Your Crypto DeFi and NFT Taxes in as little as 20 minutes. Crypto income is declared on question 2 of Tax return for individuals 2022 NAT 2541.

Crypto commissions are only 012-018 with no hidden spreads or markups. Ad Trade crypto plus stocks options futures bonds funds and more on one platform. Crypto tax deadline in Australia.

The ATO has the following instructions for calculating and reporting crypto capital gains. The tax year in Australia runs from the 1st of July to the 30th of June the following year. The tax rate on this particular bracket is 325.

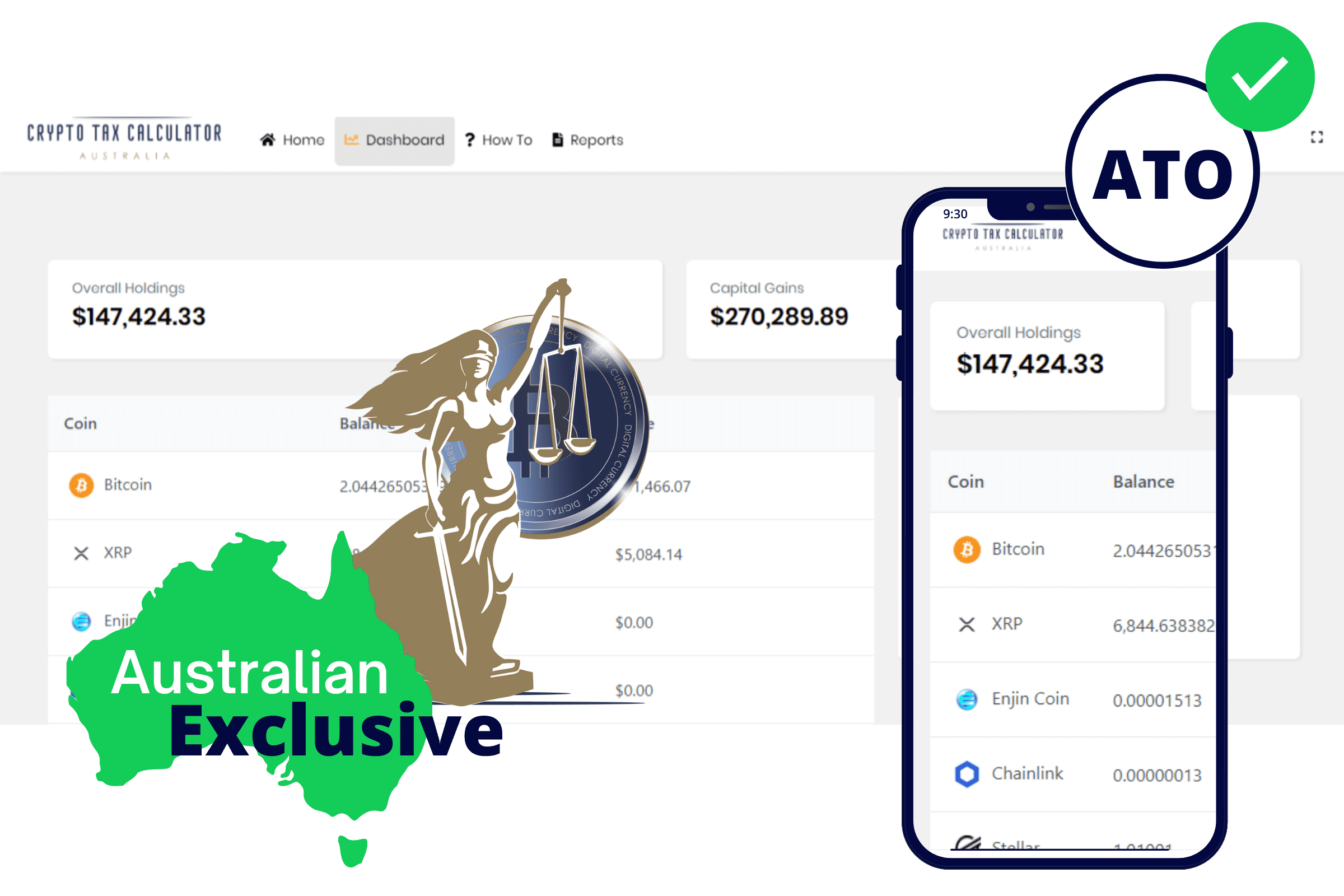

Swyftx provides excellent features and services and they have actually managed to do it with reasonably low costs. Built to comply with Aussie tax standards. Crypto Tax Calculator for Australia.

You simply import all your transaction history and export your report. This means you can get your books. Records may be requested at the discretion of the ATO and.

At Crypto Tax Calculator Australia their state of the art application. June 27 2022. Calculating your crypto tax in Australia can be quite a daunting experience at first glance however it does not need to be.

Crypto commissions are only 012-018 with no hidden spreads or markups. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in. If you are completing your tax return for 20212022 you.

This is the price of your cryptocurrency plus any expenses.

Cryptoreports Google Workspace Marketplace

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

11 Best Crypto Tax Calculators To Check Out

11 Best Crypto Tax Calculators To Check Out

Do You Mine Coins Whether Your Mining Is Active Passive Or Hobby Income Depends On How Much Time And Personal Bitcoin Mining Bitcoin What Is Bitcoin Mining

Crypto Tax In Australia The Definitive 2022 Guide

Income Tax Calculator 2020 21 Calculate Taxes For Fy 2020 21 Income Tax Slabs 2020 21

Cloud Service Provider Oracle Chosen By Australian Data Centres To Promote Secure Federal Government Workl Cloud Computing Services Cloud Services Oracle Cloud

Best Crypto Tax Software Top Solutions For 2022

Crypto Tax Calculator Australia 2022 Calculate Profit And Tax For Free Marketplace Fairness

11 Best Crypto Tax Calculators To Check Out

Top 10 Australian Exchanges For Crypto Taxes Koinly

11 Best Crypto Tax Calculators To Check Out

Crypto Tax Calculator Australia Calculate Your Crypto Tax